Giving to the Interlake Community Foundation is easy and the funds will help your community forever! Your gift will be pooled with other gifts that will ensure maximum potential earnings at a minimal administrative expense. It’s a great way to create a lasting legacy.

Gifts and donations to the ICF may qualify as gifts to a registered charity for income tax purposes, and the ICF will issue the required receipt.

Your donation can be made in several ways:

-

- Endow Manitoba’s website – To donate to the Interlake Community Foundation securely with a credit card on-line, please click here All credit card donations are processed and receipted for us by the Winnipeg Foundation and you will receive a charitable receipt by email.

- Download our donation form if you wish to mail in a cheque General donation form ICF

- If you would like to send an e-transfer, please use info@interlakefoundation.ca and follow-up with an email to us with your name and mailing address so that we can send you a donation receipt.

- An Annual or Monthly recurring gift. You make an initial contribution and a commitment to add to the initial donation over a period of months or years. Click here to set up with a credit card and click “make a repeating gift” https://www.mycharitytools.com/gift/wpgfdn/donate?fund=254

- Publicly listed securities. This link will take you to the information needed at the Winnipeg Foundation, where most of our funds are invested. https://www.wpgfdn.org/giving/gifts-of-securities/Donating gifts of securities (including stocks, mutual funds and bonds) is a great way to support your community and reduce your tax bill. When you transfer securities to the ICF through the Winnipeg Foundation, you receive a tax receipt and eliminate capital gains tax. The Winnipeg Foundation does not charge the ICF a fee to process these transaction. Please speak with your financial or tax advisor to see if this is the best option for you. Click here to download the Gift Transfer Form: WpgFdn_-_Securities_Transfer_Form-CIBC

- A bequest in a will;

- A gift of life insurance by naming the Interlake Community Foundation as a beneficiary;

- A gift in memory of a relative or friend. If you give us the name and address of the family, we will send them a card to let them know you have made a memorial donation.

- Pop by our office in the Town of Stonewall Building at 293 Main Street in Stonewall, top floor. If no one is in the office, just slide it under our door. Tracy and Joanne are working there two days each week. Office hours are Mondays and Wednesdays, 9:30AM to 3:30PM. Please call if you’d like an appointment 204-467-5634 at a different date/time – we will do our best to accommodate you.

You can donate to any of our funds, or leave it unrestricted to be used where we need it. For a list of our funds, visit https://interlakefoundation.ca/our-funds/ click the fund name for more info on each fund.

The Foundation provides an excellent opportunity to help your community forever.

- Named endowment funds can be set up for as little as $5,000 that will ensure your family, business, or loved one is remembered in perpetuity.

- Named funds will receive continuous recognition in various formats – on our social media, on our website, in our annual newsletter, in our financial statements, at our Grant Celebration and our Annual General Meeting.

- Your fund can provide a scholarship to a student, a grant to a designated charity, or be unrestricted for the ICF to allocate with our Community Grants Program. Contact us as there are several options including permanently endowed funds, flow through funds and spend down funds.

- Fund grant allocations can only be paid to a qualified donee as listed by the Canada Revenue Agency, https://www.canada.ca/en/revenue-agency/services/charities-giving/charities/policies-guidance/qualified-donees.html

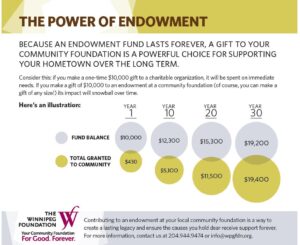

- Our permanently endowed funds are intended to last forever! We invest the donations and only pay out the grant disbursements from the income on the fund. This amount is usually between 3.5 – 5% of the Fund’s market value annually. A fund with a market value of $10,000 would annually make a grant of $350 to $500.

The Community Builder Club is another alternative that only requires a commitment to give monthly or annually with your credit card to the fund that supports your community.

Please contact Tracy Holod at 204.467.5634 tracy@interlakefoundation.ca or speak to any of our Board members for more information.